Technology, like Bama Cash, Dining Dollars and meal plans, can allow students to spend money without fully comprehending what has happened – a quick swipe of an ACT card and the deal is done. This way of spending could explain the decrease in student credit card usage.

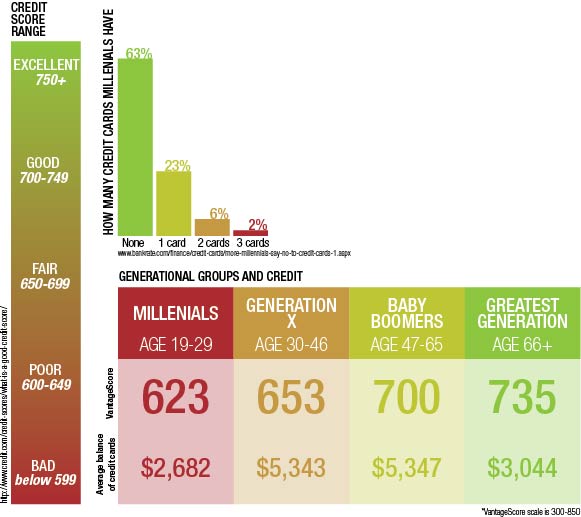

BankRate.com, a personal finance site, surveyed young people ages 18 to 29 and found 63 percent did not have any credit cards. Robert McLeod, a professor of finance and a John S. Bickley Fellow in insurance and finance, said he thinks this reluctance stems from the ease of misusing plastic money.

“Used wisely, there’s nothing wrong with credit cards, but the problem is with the misuse of credit cards, mainly because people don’t keep track of the expenditures,” he said.

Two common reasons students give for getting a credit card are establishing good credit and providing a safety net of emergency funds. Alexis Killough, a senior majoring in English and political science, has had a student credit card in her name since she was 18 years old.

“We were looking ahead to a time when I will no longer be dependent on [my parents] and so would need a credit score of my own to make large purchases,” she said. “We decided it would be better for me to start this process now, while they can still support and assist me.”

Killough said she could handle the responsibility because she practiced money management skills through her babysitting jobs for years.

Once a student decides to commit to plastic, the next step is to decide between a secured or unsecured card. McLeod said a secured card is easier to procure, especially if one has a bad or nonexistent credit history. Since building good credit is one motivation for getting a credit card, secured cards can be stepping stones.

“Some [cards] are secured cards, where you actually have to make a deposit into an account, say, three hundred dollars,” he said. “Then you’ve got a credit card with a three hundred dollar line, but it’s secured by that three hundred dollar deposit.”

McLeod said he suggests looking at a credit union or another financial institution that offers student-related programs. These programs normally offer lower rates and require a financial training program to ensure the participant possesses basic money management skills.

One example is the Alabama Credit Union located on the second floor of the Ferguson Center. Jo Broadwater, a member services representative for Alabama Credit Union, said the credit union’s lowest level credit card is perfect for students who want to begin building a credit history.

“Our credit cards for students have a $500 limit for the students because we don’t want to leave them in any sort of debt,” she said. “For our level one card, which is what the student card is, is a 12.9 APR card, which is excellent.”

To acquire a level one card with the Alabama Credit Union, students must fill out an application, provide proof of income and take an online “Budget Basics” quiz on greenpath.com. Tonya Cargile, branch manager of Alabama Credit Union, said Greenpath serves as a free, secondary resource for all credit union members.

“They’re certified financial planners and counselors who can look at how to build credit, how to improve credit, how to clean your credit up,” Cargile said. “They also have a great opportunity for students where they teach you about student debt, they offer other suggestions instead of going into student loan debt, and they offer plans on how to get financial aid.”

When investing in the unsecured card, McLeod said people should look for cards that offer features similar to secured cards, including low or no annual fees, a low interest rate and a grace period before payments are due.

For those looking to establish a good credit history, there are alternatives to credit cards. McLeod mentioned credit union loans and merchant cards as ways to begin a credit venture.

“If you are a member of a credit union, go make a small consumer loan,” he said. “Put it in a savings account, and when the loan’s due, go pay it back. You can establish credit through a merchant card, which is a form of credit card, but it’s restricted to use at that particular merchant’s location – for example, a Belk card will certainly establish credit for you.”

A person’s credit history is not just a fiscal concern anymore. McLeod said employers often consider an applicant’s credit history during the interview process, and a bad score can have negative effects.

“What the students need to be aware of is a lot of potential employers will look at your credit history to determine whether or not you get that second interview,” he said. “So if you’re applying for a finance job, then they find out you’ve got a bad credit history, bad checks, late payments, haven’t paid utility bills, you’re not going to get a job. You absolutely will not get a job.”

In determining readiness for a commitment to plastic, Killough said maturity is a greater factor than age.

“I think it is great for college students to have a credit card if they are ready to take on the responsibility,” she said. “It is very easy to get into trouble if you are not prepared for all that having a credit card entails.”

McLeod said responsibility and self-control play a huge role in determining the positive or negative impact of a credit card. He said it may be more difficult for people to track spending if they don’t see the physical transfer of paper money or a check. He said adding self-control to the list of factors that need to be considered pre-credit card.

“The key is just discipline,” he said. “There’s nothing really wrong with a credit card if used wisely and correctly. It’s just the impulse buying and the not keeping track of the expenditures every month that gets people into problems.”