By Cole Booth and Dylan Walker

Sara Garzi came to The University of Alabama in Fall 2013 and opted to be covered under the UnitedHealthcare StudentResources health care plan for international students. But after a trip to the hospital, Garzi, an exchange student from Italy, was still billed for more than $14,000 after the UHCSR plan did not cover the visit.

“I was very scared because it was my first week in the United States, and I was alone,” Garzi said. “Even now, it’s not finished. There’s some amount of money that I don’t know if I need to pay or not.”

For many college students, when it comes to health insurance, staying on their parent’s insurance may be the best option, said Chris Kissell of Insurance.com in a December 2013 ABC News article. But when this option is not feasible, Kissell listed insurance offered through the student’s university as the second-best option.

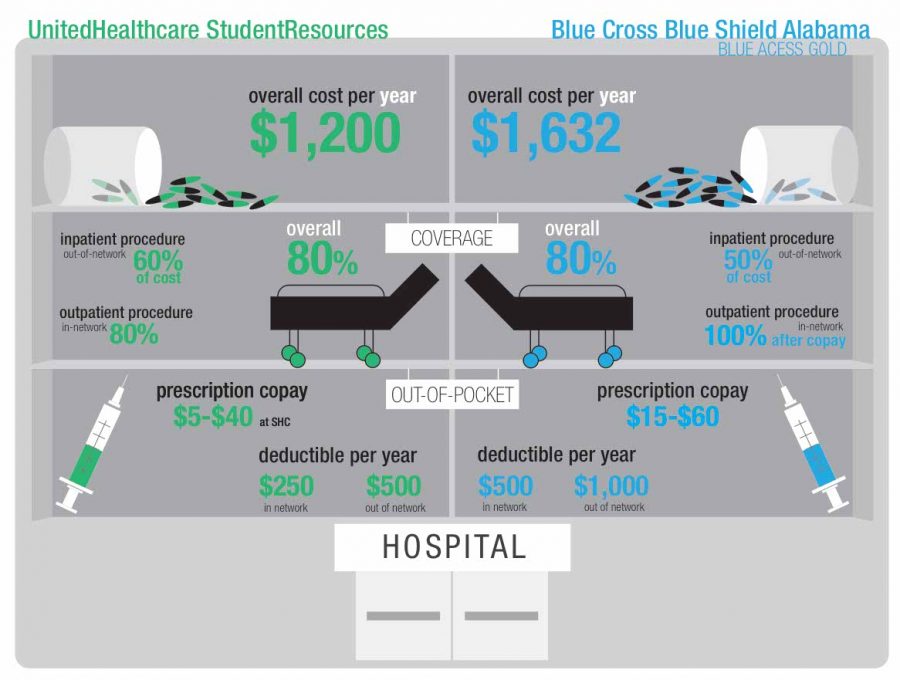

The University of Alabama offers two health insurance plans through UHCSR: one for domestic graduate and undergraduate students and the other for international students and sponsored graduate students. Both plans are $1,200 per year for an individual, $2,811 for their spouse and $1,568 for each child.

(See also “University students reach out to international peers“)

The drawback of the plan is that some students have to pay out-of-pocket for services that are not covered out of network. This issue can be further complicated for international students due to government regulations.

The UHCSR plan covers 80 percent of costs incurred within in-network clinics, which would be the Student Health Center at the University. One hundred percent of preventative services are covered; however, no coverage is offered for routine dental treatment, eye glasses, hearing aids and tests and elective abortions.

“The No.1 benefit that you would see is that we actually have a connection with the insurance company,” Charter Morris, director of Capstone International Services, said.

Morris oversees 1,670 international students, 1,600 of whom are on the University’s health plan as of Fall 2013. Morris cited a situation where UA staff interceded for a student who was denied hospital coverage after a car accident. He said they were successful in securing the student’s benefits due to their knowledge of the insurance company’s policies.

“When there is an issue or a claim that’s not being processed, we can actually get in touch with the insurance company,” Morris said. “The Student Health Center can reach out to them on behalf of the student. We can’t do that when we don’t have a relationship with the insurance company.”

Other benefits of the coverage include maternity and pregnancy care, medical evacuation and post-mortem repatriation. UHCSR waives the $250 annual deductible when students see doctors at the Student Health Center, John Kasberg, senior insurance officer at the University, said. International students, who are required to have health insurance comparable to the UHCSR plan, are drawn to these benefits.

Enrollment in the coverage plan averaged 1,400 to 1,600 domestic students since Fall 2010. Kasberg said international enrollment increased from 500 in Fall 2010 to 1,100 in Fall 2013.

“This is probably due to UA enrolling more international students overall,” Kasberg said.

Under the Affordable Care Act, students may remain under their parent’s insurance until age 26. Kasberg said this has not decreased enrollment because the act also requires everyone 19 and older to have health insurance, which is called an individual mandate. According to Healthcare.gov, the act does have exclusions, including religious groups and persons under 65 making less than $10,000 per year, so some students may be exempt.

(See also “Budgeting college students burdened by excessive costs“)

Morris said that while coverage gaps exist for any plan, it is imperative for all students to have health insurance. He said he encourages international students to learn the ins and outs of the U.S. health care system. Morris said domestic students should also research their health care yearly to make sure they choose a plan that fits their needs.

“Is it worth it? I would say so,” Morris said. “We’ve had numerous incidents with students who’ve really needed coverage, with tens of thousands in medical bills. It’s just a law of averages. It will happen at some point, it’s just a matter of when and to whom.”

(See also “Bama Covered educates public on health care“)