In 1929, the stock market crashed. In 2008, mortgage-backed securities sent shock-waves through the country. According to numerous experts, a student loan crisis could be the next big hit to the U.S. Economy.

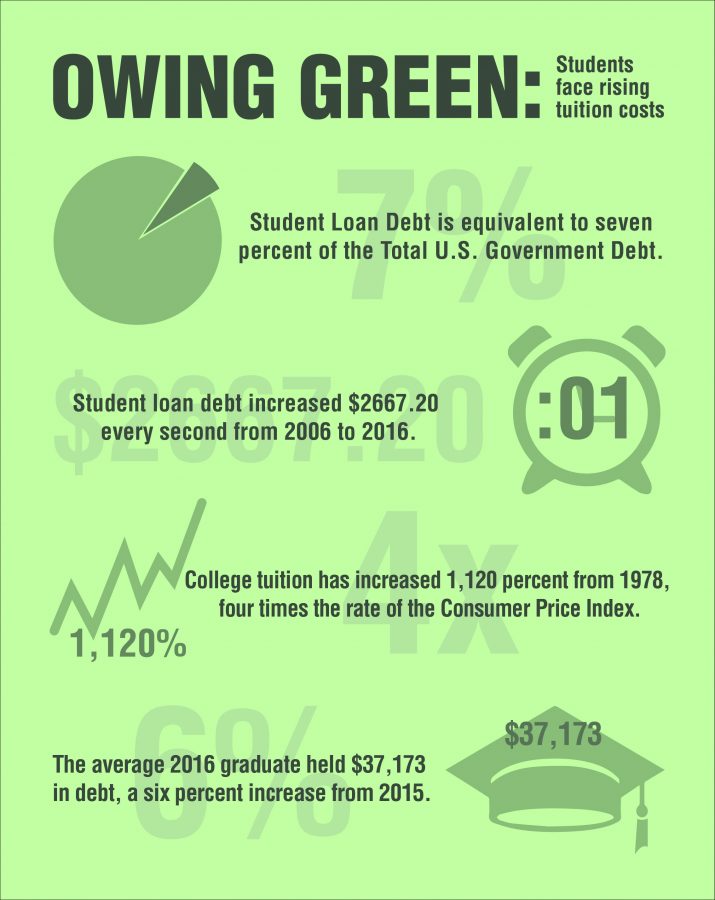

The cost of tuition for colleges in America continues to rise. Bloomberg Media reported in 2012 that college tuition rates have inflated by 1,120 percent since records began in 1978, outpacing the consumer price index inflation rate by four to one. Meanwhile, Market Watch, a subsidiary of the Dow Jones and Company, has pinpointed, using data from the Federal Reserve, that student loan debt increased $2667.20 every second from 2006 to 2016.

To compensate for the steep increase in costs, student loans have become one of the largest sectors of debt for American citizens, outpacing auto and credit card debt to become the second highest overall behind housing mortgages.

According to CBS News, Americans owe almost $1.41 trillion in student debt, and that number has shown no signs of going down. The average 2016 graduate held $37,173 in debt, which was a six percent increase from the previous year.

“Being pre-med, I accepted that fact very early on that I will be in debt, and probably will be in debt for quite some time,” said Matthew LeSieur, a senior majoring in chemical engineering. For students entering pre-professional schools like medical school, the average debt is even higher.

College Board reports that 54 percent of students in doctoral professional degree programs owed over $120,000 in debt during the 2011-2012 cycle, which is worsened because interest rates on student loans increase with each degree earned. In addition, the percentage of students owing under $40,000 combined for undergraduate and graduate degrees declined from 79 percent in 2004 to 53 percent in 2012, indicating a large increase in the amount borrowed.

Daiquiri Steele is a Professor of Law at the University of Alabama Law School. Steele formerly worked as a civil rights defense lawyer in the Department of Education under the Obama Administration.

“The U.S. Department of Education has largest student loan program in the nation, in the world actually,” stated Steele.

The Office of Student Aid within the Department of Education awards over $150 billion in grants, low-interest loans, and work-study funds each year. Steele said that this number could go down, however, especially given the newest Secretary of Education, Betsy DeVos.

“I would not be surprised if there was a push towards private student loans, and even the privatization of loans entirely,” said Steele.

DeVos has said private banks could become the primary loan-providers for students, especially if the Department of Education is downsized. Steele also said that she would not be surprised to see regulation rolled back on private student loans.

The Consumer Financial Protection Bureau lists the differences between federal and private loans in that private loans can have variable interest rates and less flexible loan payments. Variable interest rates expose the student to increases in interest rates, which will be likely in the coming years as Federal Reserve raises the near zero interest rates it has kept following the 2008 recession. Furthermore, private loans often require a co-signer with rates dependent upon the student and their co-signers credit rating.

“Trump has definitely made it clear that he wants smaller government, and to make education a states’ rights issue,” said Daniel Ashford, a senior majoring in finance and member of the College Republicans. “I think the Department of Education has gotten too powerful under federal government.”

Ashford said the student loan situation has worsened in the past eight years under the Obama administration, but he did not think Obama was to blame. He did however, expect Trump to stymie the debt epidemic through debt forgiveness programs. “Trump will probably improve the system we have for debt forgiveness,” Ashford said.

Under President Bush in 2007, a loan forgiveness program titled Public Service Loan Forgiveness was created for federal workers that would absolve all student debt for federal government employees that paid a portion of their loans at a monthly price based on income for ten years.

According to Steele, this program reached fruition six weeks ago for those that first enrolled. However, the American Bar Association is now suing the Department of Education for failure to pay off these loans.

President Trump and his Cabinet members have yet to address this issue publicly, so it is unknown how the administration plans to proceed with this program.

Mike Smith is a sophomore majoring in economics and finance as well as a member of the College Democrats. Smith, not believing that the Trump administration possesses the necessary understanding of U.S. Government, said he expected programs for loan forgiveness and others to falter.

“I think if there is already a defunct-ness, I do not expect it to get any better under Betsy DeVos,” said Smith. “I am worried about them being defunct about program that we already have in place, and I expect it to get much worse.”

Smith said his hope was that programs for refinancing loans could be implemented to allow those who took on high interest rates in the 2000s to reduce their current interest rates, but with the nomination of Betsy DeVos as Secretary of Education, and with Trump’s proposed student loan refinancing option, he saw no such opportunity arising soon. Smith in favor of the student loan payment option put forth under the Obama Administration.

“I think Trump’s plan is a little more aggressive, and can saddle graduates with more obligations immediately after college. It’s a fair strategy, but I prefer the REPAYE program,” said Smith.

Reuters News reported that the Federal Reserve has advised higher interest rates going forward. This is in response to signs that the economy will improve, and according to Federal Reserve officials is necessary to prevent a recession.

On the other hand, projected incomes are also on the rise. CBS News reported that the average income for recent college graduates has risen to $43,000 in 2015, 7.5 percent ahead of 2014. For high school graduates, unemployment was 17.9 percent, but for college graduates was only 5.6 percent.

Even so, the $1.3 trillion debt is only projected to increase as tuition rates continue to rise. Over 44 million Americans make up the pool of people in debt to student loans, and the demand for a college degree is still on the rise, making student loan debt as American as apple pie.