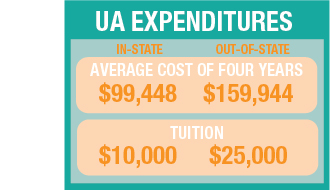

The University’s Office of Student Receivables provides students and parents with information about the estimated cost of attendance. According to the office’s estimates, in-state students will pay about $99,448 over their four years at The University of Alabama. Students from elsewhere in the United States, making up more than 60 percent of the UA student population, will pay around $159,944 over the course of their undergraduate careers.

Cathy Andreen, director of media relations, said each student is different when it comes to their finances.

“Obviously, the amount that a student spends varies greatly from student to student, depending on where they live – especially when they move off-campus – their lifestyle, etc.,” Andreen said. “Of course, out-of-state students pay significantly more in tuition.”

Most of this money initially goes toward tuition, which is almost $10,000 for in-state students and almost $25,000 for out-of-state students. Meal plans and residence halls make up the next two largest expenses.

To many students, the prospect of having to spend years after college working to pay off student loans makes attending a four-year college a daunting financial challenge.

Corrin Coleman, a freshman majoring in political science, said students need to have a positive attitude and avoid worrying.

“Student loans aren’t a scary thought,” Coleman said. “You just have to accept that you need one to go to your dream school. Mostly you worry about what will happen if you don’t get a loan. What happens next if you can’t pay for school?”

The expense of college is widely viewed as an investment in one’s future that will eventually pay itself off.

“Usually you have plenty of time to pay off student loans,” said Caroline Henley, a freshman majoring in communicative disorders. “Education is your best investment, so the high cost is worth the reward that education brings later in life.”

In 2013, the nonprofit organization College Board, which aims to inform students on college opportunities and provide ways to succeed in a college setting, stated that during a 40-year full-time working life, the median earnings of bachelor’s degree recipients without an advanced degree are 65 percent higher than the median earnings of high school graduates.

Some feel that, although the price of college attendance is rather expensive and will lead to a short-term financial crunch, attaining a degree will pay for itself in the long run.

“People often make the mistake of focusing too much on monetary investments and neglect investing in themselves,” said Michael Sihr, a freshman majoring in computer engineering. “The investment made in one’s education will pay much greater dividends, both monetary and personal, later in life.”