Looking at Kiva.org, visitors can find an image of a woman named Nelita, a 33-year-old married mother of five living in the Philippines, selling charcoal. Scroll to the right, and there is Vincent, a member of the Chwele district in Kenya, representing the One Acre Fund group. Each of these people pictured is looking for a business loan, and now you can help them.

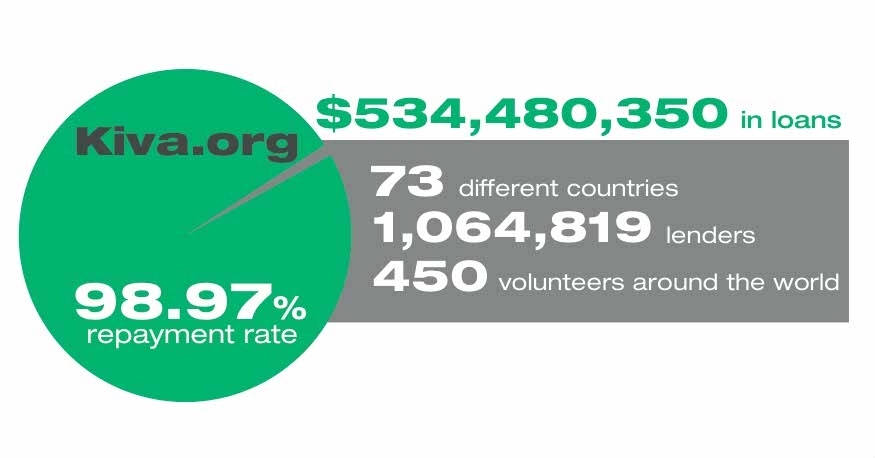

Kiva.org is an organization represented in more than 70 countries that was started in 2005 by Matt Flannery and Jessica Jackley. The website allows anyone to lend as little as $25 to impoverished countries around the world. The University began its work with Kiva in 2009 and since then has made 307 loans worldwide. Kiva’s current portfolio manager at Alabama, Truc Phan, is a senior majoring in finance, math and management. Phan is a part of the Enactus group that helped her, for the past year-and-a-half, work on the ABC – Academic Business Cultural – project, a business mentoring program for middle and high school students.

“We won [the] national championship last year for this project,” Phan said. “It’s a nonprofit organization for student leadership, but sadly not a lot of people know about Enactus, and we really need more students to spread the word.”

(See also “Business competition funds winning startups“)

In order to begin making loans on Kiva, the lender does not have to provide money out of pocket. With a budget of about $7,000, the Enactus group will loan money, starting at the minimum of $25, to whomever the lender chooses as a borrower. The lender may then follow the loan periodically and receive updates on repayments. Any repayments the lender may keep, but they are encouraged to make another loan or invite someone from the University to join Kiva.

David Ford, an advisor for the Kiva project at the University, said he has seen the group grow tremendously since its inception, and that it comes in second in term of loans than almost any other worldwide college affiliated organization.

“I see continued growth, even though many other organizations have copy-catted Kiva,” Ford said. “It now is making loans to impoverished areas within the United States instead of just third-world countries. I think students don’t know about it because there are so many different student organizations on campus. It’s like picking your favorite cereal, there are 50,000 options and each one is great.”

Students from other student organizations have tried to benefit from other crowd fundraising platforms including Kickstarter and Indiegogo.com, the predecessor of Kickstarter that promises money immediately to the lender, unlike Kickstarter.

(See also “Alumni jumpstart program with online fundraising“)

Gofundme.com launched in 2010, using the same crowd fundraising platform, but instead is used to fund life events such as trips, graduations, accidents and illnesses. The Resonance Show Choir is traveling to Orlando, Fla., on April 4 to host the “Fame” national show choir championships. In an effort to raise money quickly for their trip, president Morgan Mullen, a junior majoring in human development and family studies, turned to gofundme.com for help.

“We actually didn’t raise that much; we only raised about $200 out of the $19,000 that we needed,” Mullen said. “It was little, but that’s because people are wary of putting their information online.”

“We actually only got $180 because the 10 percent was taken out,” Mullen said. “Gofundme.com requires you to link it to Facebook, so it was linked to my Facebook account. But it made it hard to share because it had to go through me instead of the Resonance Show Choir account. It made it hard for everyone to see, and only my group of friends could see it.”

Resonance Show Choir is planning to raise the rest of its money by hosting percentage nights at restaurants around Tuscaloosa. The FAC is funding its travel expenses since it is a student organization. Benefits from the fall show go toward the total as well as the cabaret show in the spring. Gofundme.com deposits the money received into a direct account but takes 10 percent from the total received.

There are both benefits and downfalls to crowd fundraising, but if students are interested in joining UA-Kiva, Ford said it is a safe and secure way to lend money to people in need.

(See also “Site funds creations of students, professors“)