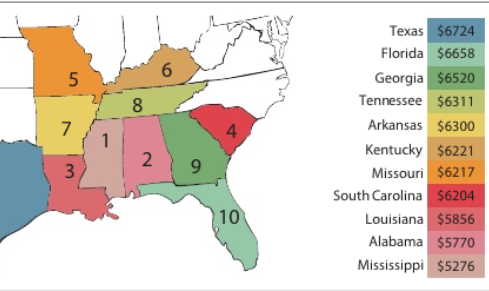

The state of Alabama holds the third lowest average credit card debt for cardholders in the nation, with only Louisiana and Mississippi retaining lower balances.

The average Alabamian debtor owes only $4,588 per person, according to a new report from online credit rating site Credit Karma, the average credit card balance in the state is continuing to shrink.

Many students at the University of Alabama use credit cards in place of cash or debit cards — the flexibility afforded by credit cards and the ability to pay back one’s balance at a later date contribute to their popularity. But does the seemingly statewide penchant for frugality also extend to University of Alabama students?

“I have a credit card, but I try to avoid using it if at all possible,” William Stokes, a junior majoring in history, said. “My parents helped me get my credit card shortly before my freshman year, but it’s always served more as a backup as opposed to my main form of paying the bills. I just don’t see the convenience of paying bills later as a viable excuse for accumulating a sizeable credit card debt subject to exorbitant interest rates.”

While many students use their credit cards only in necessary cases, others don’t have the luxury of using a credit card at all. Because of their age, many students lack measurable credit, impeding their ability to obtain a credit card to use at all and forcing them to choose between using cash or debit cards distributed by their banks.

Some students without credit cards simply elect not to apply for credit cards at all, viewing credit cards as more risk than reward.

“Having a credit card would definitely be nice, but it’s not really something I need at this point,” said Tim West, a sophomore majoring in business. “I get all the convenience of a credit card with my debit card without having to worry about overspending what funds I have access to. In case I lose it, I also feel a lot safer knowing that most businesses won’t accept a debit card if the person using it doesn’t know the bank pin.

Despite the inherent risks involved with having and regularly using a credit card, some students see credit cards as the most reasonable way to help finance the life of a full time student. Additionally, because many students still rely on their parents financially, parents may play a role in forestalling student debt.

Many parents can link bank accounts and pay off their students’ credit cards directly from their own accounts, a tool that makes the job of monitoring student spending much easier and often helps to mitigate credit card debt. But when asked about the use of credit cards by students, many students at the University of Alabama see the practice as totally unnecessary.

“I just see the whole idea of students having and using credit cards as a frivolous waste of their parents’ money,” Hilary Ernst, a junior majoring in social work, said. “I feel like many students do not have a solid concept of what it’s like to pay back loans. Their parents pay for so much right now and it’s no big deal to just go charge something unnecessary onto their account.”