This Halloween, I’m dressing up as the scariest thing I can imagine. And no, it’s not Donald Trump – it’s student loan debt.

What makes student loan debt so spooky is only partially related to the damage it causes those who carry it. Equally frightening, and often overlooked by scholarship-wielding students, is the threat student debt poses to those who don’t have any at all.

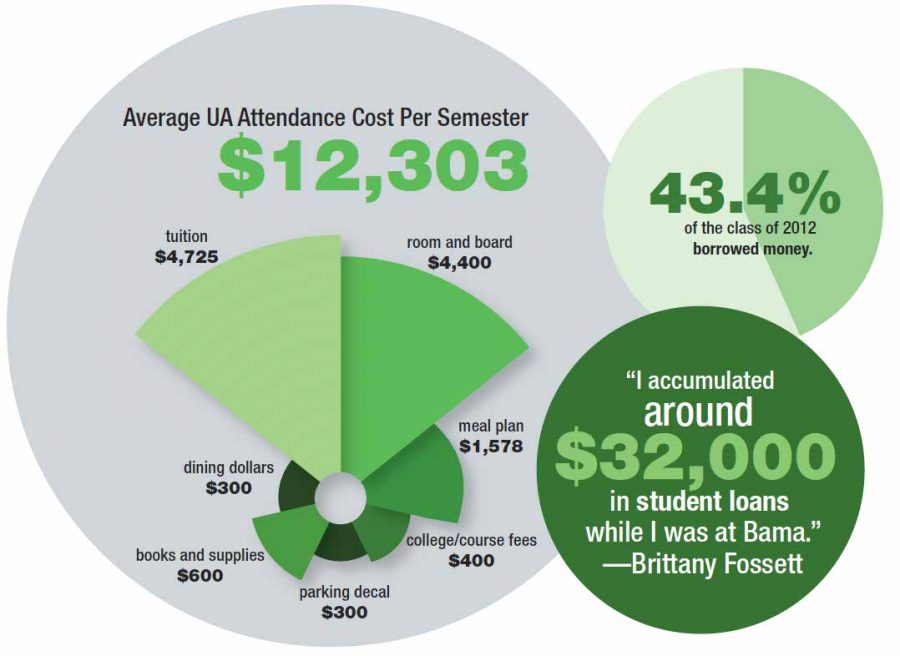

You heard me correctly. Student debt affects everyone and poses one of the single greatest threats to the American economy in the 21st century. It comprises over $1.2 trillion of the total U.S. debt. If that doesn’t scare you (which it should), then it should at least make you angry (which it will). Scholarship or not, student loan debt is the real American horror story.

This problem is complex and the implications may mean you will have a harder time buying a home, starting a business or even getting married and having kids. The situation can be divided into three separate parts, beginning with a broken loan system.

Cruise Hall wrote a great piece on the subject last year in which he explained the broken system by which the Federal government incentivizes bad loans to college students. I encourage you to read the column, but the Cliff-Notes version is this: the government loans money to college students indiscriminately, usually giving more money to the students least able to pay it back.

While enabling more students to attend college is a usually a good thing, encouraging risky loan practices isn’t. Many people like the idea of “free college,” thus by definition ending student loan debt. This doesn’t work (Sorry Bernie.). This debt is still incurred, it’s just allocated differently within the government – arguably the worst organization for debt management.

But I digress.

Imagine a business administration major (the most popular major in the U.S.) who graduated in 2014. Business administration students report an average starting salary of $41,200. With some student debt piles as much as $100,000, students like our hypothetical business administration student quickly find themselves behind on their payments. They default. The debt grows. And unfortunately, there’s no easy way out.

This is the second part of the problem. You see, when a business borrows too much money, it can declare bankruptcy. The debt is erased. When an individual borrows too much for a house, they can declare bankruptcy. Sure, they lose the house, but the debt is also gone.

When a student can no longer make payments on their student loans, however, bankruptcy offers no solace. Student loan debt can’t be erased. It’s a confusing part of bankruptcy law that causes a lot of headaches.

This leads to the third part of the problem – how it affects our future. When students have excess debt, their lives fundamentally change. More debt makes it harder to get loans. Loans for houses and cars – the kinds of loans needed in settling down and starting a family.

When loan applicants have bad credit, the terms of their loan agreements will become less lenient – meaning capital will flow less freely in an environment already saddled with a high debt burden.

Less money in the marketplace means fewer new businesses and less spending, and less spending means less money in your pocket. I don’t have to take you down the “if you give a mouse a cookie,” scenario for you to see where this is going.

Millions of businesses and families that will never start. A slower economy. A torn American fabric. See? I told you that you’d be angry.

So what can we do about it? I don’t really know. I think we can start by fixing the federal loan program. Then we can start finding more sustainable ways of funding higher education, like Georgia’s HOPE Scholarship, which is funded through a lottery. More on that soon.

In the meantime, don’t forget how student loan debt affects you, even if you don’t have any yourself. You can’t afford not to care.

Ben Jackson is a sophomore majoring in accounting and finance. His column runs biweekly on Wednesdays.